USAID and USEA Drive Electricity Security for its Allies in Southeast Europe (SEE) through a New Electricity Market Initiative (EMI)

Elliot Roseman

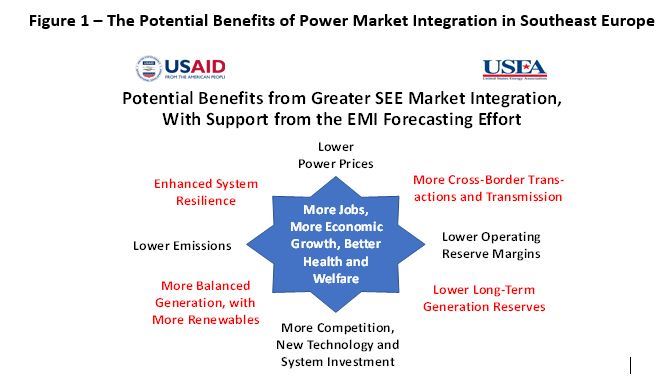

In a pathbreaking project, the transmission system and market operators (TSOs and MOs) in eight countries in SEE are working to integrate their electricity markets for the benefit of millions of customers. With funding from the US Agency for International Development, the US Energy Association (USEA) is spearheading the EMI by convening the stakeholders, conducting analyses, and considering policies that will help realize the benefits – economic and otherwise - of such consolidation. Figure 1 below illustrates those objectives.

USEA is also proactively engaging the region’s regulators as observers to the EMI working group, since the issues that the EMI is dealing with could clearly have regulatory and policy implications. We are further mobilizing the knowledge of international experts from Europe and North America to share best practices and guidance, while recognizing the need for the EMI to tailor the path of progress to this region.

Unlike much of the rest of Europe, this region’s electricity generation, transmission and wholesale power sales remain largely balkanized, with bilateral deals between the incumbent utilities making up the bulk of cross-border transactions – whether for wholesale power, balancing or day-ahead sales. There are promising developments, such as a new soon-to-be-energized cable across the Adriatic Sea to Italy, emerging power exchanges, the “coupling” of several countries’ markets.

In this context, the EMI seeks to create an exchange-based regional power market where none exists today, one that would lower and ultimately eliminate the seams between countries. This would create a critical mass to attract more private capital to the wholesale power sector. Further, a larger market with a robust grid would support both competition and innovation, and create fertile ground for more foreign investment and renewable generation to flourish and flow across borders.

In addition to the 11 companies that are now EMI members, several more may join soon (Figure 2 illustrates our current geography). After a definitional mission in April, and successful working group meetings in July and October, the next gathering will be in February 2019, when the EMI members will consider in detail the scenarios to analyze that will demonstrate and quantify the extent to which a regional day-ahead market would be viable. After evaluating day-ahead opportunities, the EMI may turn its attention to demonstrating the benefits of joint agreement on hourly transmission transfer capacity across borders, which could make a meaningful difference in day-to-day flows and customer access to the most cost-effective power.

In conjunction with USEA’s work, other agencies such as the National Association of Regulatory Utility Commissioners, the Energy Community Secretariat, and the European Network of Transmission System Operators for Electricity are actively working to bring SEE into a new era. USEA has other working groups in the region, including ones focused on electricity distribution, natural gas and cyber security. For more information, please contact Elliot Roseman, Program Director at USEA, at eroseman@usea.org, and 202-312-1255, and visit www.usea.org.

Latest Thinking and Initiatives on the New Climate and Circular Economy

Janine Finnell

As a member of The National Capital Area Chapter of the United States Association for Energy Economics, whose work is focused on advancing clean energy and sustainable solutions, I would like to share several recent reports and initiatives which have caught my attention in moving toward a new climate and circular economy .

The Urgency and Need for Accelerating a Transition

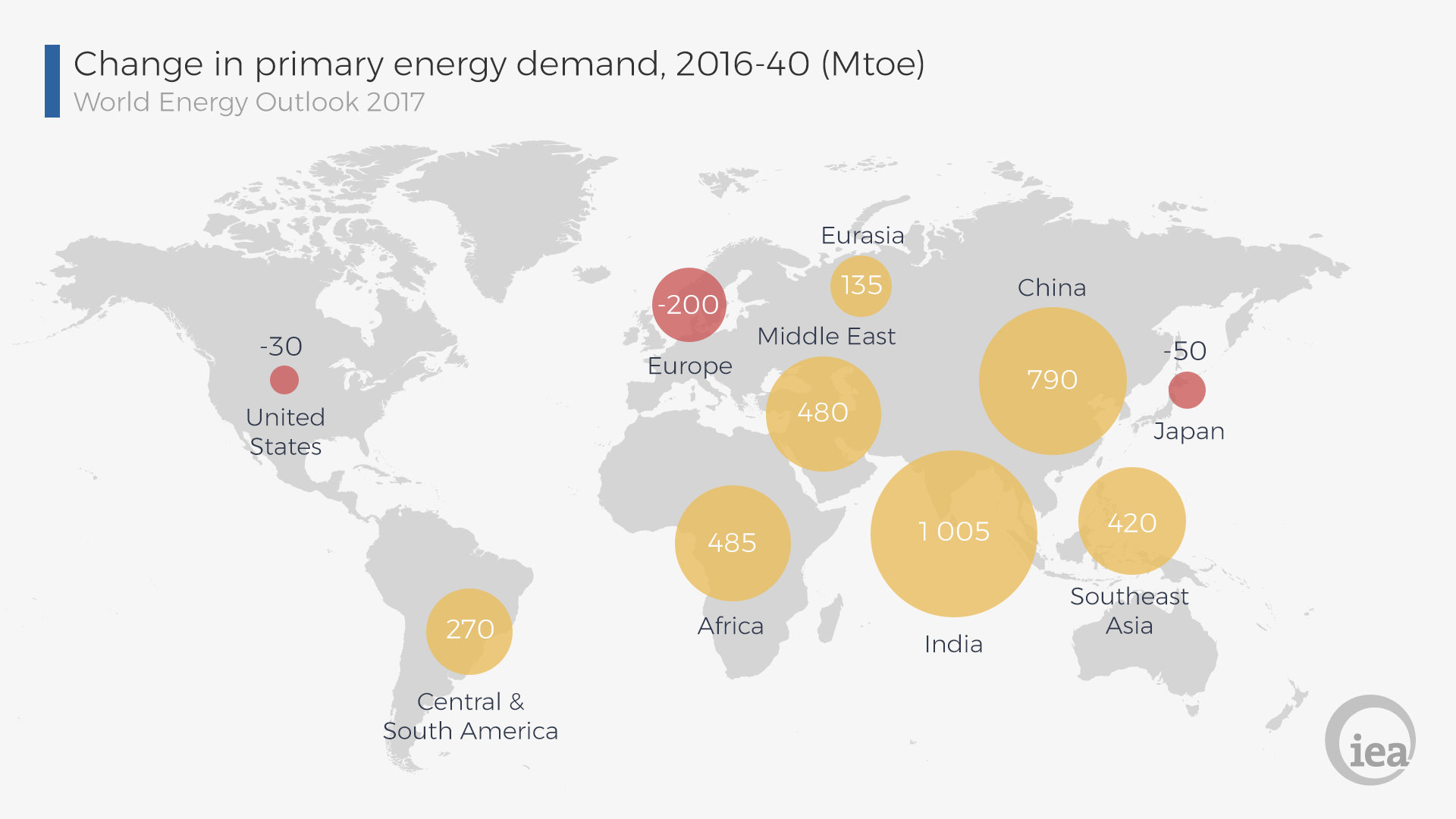

The Paris-based International Energy Agency (IEA) is a well-respected international organization that produces leading edge energy statistics and analyses of the global energy sector. Its World Energy 2017 Outlook Report points to the need to make transformative changes in the energy sector to reduce carbon emissions. The IEA examined a number of scenarios related to energy use and resulting climate emissions, including the “New Policies Scenario” and the “Sustainable Development Scenario.” The New Policies scenario was striking because their projections included the current commitments of countries under the Paris Climate Agreement. Nevertheless, global CO2 emissions and energy demand under this scenario are still projected to rise with the equivalent of adding another India and China to global energy demand between now and 2040.

The Paris-based International Energy Agency (IEA) is a well-respected international organization that produces leading edge energy statistics and analyses of the global energy sector. Its World Energy 2017 Outlook Report points to the need to make transformative changes in the energy sector to reduce carbon emissions. The IEA examined a number of scenarios related to energy use and resulting climate emissions, including the “New Policies Scenario” and the “Sustainable Development Scenario.” The New Policies scenario was striking because their projections included the current commitments of countries under the Paris Climate Agreement. Nevertheless, global CO2 emissions and energy demand under this scenario are still projected to rise with the equivalent of adding another India and China to global energy demand between now and 2040.

In the IEA’s Sustainable Development Scenario, which would reduce carbon emissions substantially, renewables, energy efficiency, and other technologies - including nuclear and carbon capture - are recommended for decarbonization along with increased electrification to obtain a radical reduction in CO2 emissions. IEA recommends that the world’s economies pursue the Sustainable Development Scenario.

Potential for a New Climate Regime and Circular Economy

A new Climate Economy Project report published by the Global Commission on the Economy and Climate entitled “Unlocking the Inclusive Growth Story of the 21st Century: Accelerating Climate Action in Urgent Times,” highlights how lowering carbon emissions can yield great economic benefit. The report estimates that taking bold new action could create USD26 trillion in new economic gains by 2030 to accelerate the transition to a better, more inclusive new climate economy in five key economic systems: energy, cities, sustainable land use, wise water management, and a circular economy. The report was produced by the Global Commission on the Economy and Climate, made up eminent economic leaders including former presidents and finance ministers, CEOs of multinational companies, and heads of leading economic organizations. The New Climate Economy project is undertaken by a global partnership of research institutes with the World Resources Institute as its managing partner.

Circular Charlotte

Many of the ideas above are coalescing in the city of Charlotte, New Carolina. This city recently released a report entitled “Circular Charlotte: Towards a Zero Waste and Inclusive City” with recommendations to implement the circular economy to help reduce waste, increase energy and water efficiency, and provide jobs in a more inclusive economy.

Four Generations Awards & Holiday Celebration on November 30th in Arlington, VA

If you are interested in these and related topics, consider attending the Leaders in Energy 5th annual Four Generations Awards & Holiday Celebration on November 30th, 6-9 pm, in Arlington, VA. Meet leaders across multiple generations who are working to advance clean energy and sustainability solutions. Our awardees’ diverse initiatives include broad-based vision and empowering action at the local, state, and international levels. They span the fields of energy storage technology, environmental justice, energy education, and ecological and steady-state economics. This will be a great way to spend an evening with others who are passionate and knowledgeable about these topics.

Energy Security and Dominance in the 21st Century Beyond Oil and Gas

Ricardo Raineri

The quest for energy security. One of the main themes which dominated the twentieth century energy discussion was energy security. That led to the creation of the International Energy Agency (IEA) in 1974, and in 1977 to the creation of the Association of Energy Economists, lately renamed the International Association for Energy Economics. Energy security concerns developed because of the excessive dependency on imported oil after the 1973-74 Arab states instituted an embargo against countries supporting Israel in the Yom Kippur War. The concerns developed in conjunction with the 1978-79 Iran oil production and export cuts and the cancelation of contracts with US companies, during the Iranian revolution. The 1973-74 oil embargo led a group of Western countries to agree to the creation of the IEA, designed to help countries to coordinate a collective response to major disruptions in the supply of oil.

The ghosts of major disruptions of energy supply, in oil and gas, motivated by geopolitical issues, remained present for the last quarter of the twentieth century and the first decade of the twenty-first century. Today, as Saudi Arabia opens the door to cut crude oil production among OPEC countries and noninstitutional participants, we are remained that these ghosts are not gone.

Since the 1970s, world population has almost doubled, the standard of living has improved, and a smaller percentage of the population lives in poverty. Over the same period, primary energy consumption has more than doubled, with a large share of that increase taking place in developing countries. We are thirstier for energy, and have seen large swings in geopolitical power, from north to south and west to east, in an unstable environment.

New Buffers for Energy Security

Beyond the large increase in population and energy consumption, there is good news on the international energy landscape, where important energy security buffers have been added.

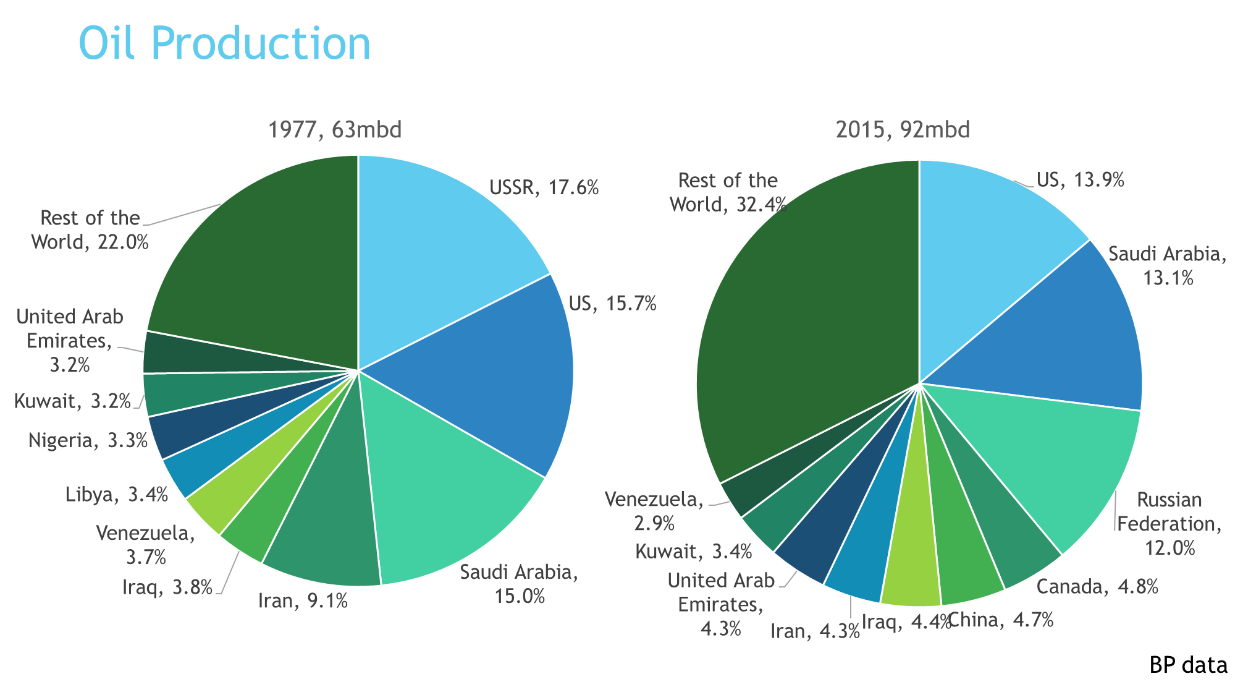

First, additional countries, some with very stable democracies and business environments, have become important oil and gas producers, increasing the diversity of oil and natural gas resources. The new players include Canada, China, Brazil, and Norway. They added an extra layer of competition to OPEC and producers from politically unstable regions and very unstable business environments. See figure 1.

Second, innovation has allowed access to primary energy sources that were unfeasible a few decades ago. That is the case of Canada with its tar sands, Brazil with pre-salt and deep oil production, Norway in the extreme weather conditions of the North Sea, and the great technological development in fracking and horizontal drilling in the US that revived its oil and gas industry. We should add the increased security that LNG technology has brought to many countries, allowing them to diversify their sources of natural gas supply.

Figure 1: Oil Production

The third factor is the fantastic technological change that has taken place in the renewable energy sector, with sharp reduction in the costs of new renewable energy sources such as wind and solar for electricity generation. In some cases, the costs are down to 1/5 of the cost in 2010, enabling these new energy resources to become an important part of the energy mix in many places, displacing conventional power generation resources such as coal and gas.

Big Changes in The Electric Grid

In the years to come, we expect important transformations in the power sector, with a larger penetration of renewables with variable production. What we will need is a redesign of the electric grid, especially in the way it is operated and in how the power plants are dispatched. And we will need the addition of large amounts of energy/electricity storage capacity, taking advantage of the new technologies. Also, great changes are expected in transportation, with a large penetration of electric vehicles that will be plugged into the electric grid, taking from and injecting energy into it.

Several European countries - Norway, Germany, the United Kingdom -have announced that by 2025 and 2030 only buses and electric cars will be permitted to transit through their cities. In China, in major cities, all public transportation buses must be electric. In Latin America, Chile is looking for a deep change in its public transportation system with the introduction of electric vehicles.

The digitalization of the electric grid is imperative to manage an increasing number of sources of supply and demand. What will be needed is a redefinition of the different power markets and the redefinition of ancillary services markets.

Storage and The Lithium Equation

Storage technologies for the electric grid and batteries for electric vehicles and electronic devices are making big improvements in their energy density and have experienced significant cost reductions. Batteries for electric vehicles have dropped to a fifth of their cost in 2010.

Even though it is too early to know what the leading storage technology for utilities and vehicles within a decade will be, lithium-ion batteries are the default choice for most personal electronics and most electric cars today. Lithium-ion batteries are cheaper, given their energy density.

Although there are other emerging technologies that might contest the leadership of lithium-ion batteries, such as solid-state batteries, supercapacitors and graphene fuel cells, still they are not at a stage of economic development to be competitive.

Who will be the winners? It`s hard to know! However, we should remain alert to the availability of resources and materials that support these different technologies.

As long as lithium-ion batteries are and remain the leading storage technology, it is important to be concerned about providing enough lithium to back a sharp increase in demand. The reliability of lithium sources is also in question. How much lithium is available today, and where is it?

Only four countries concentrate 96% of lithium production and lithium reserves. Chile stands as the leading country in reserves, with 44% of world reserves. It is one of two countries that lead the production of lithium in the world. Chile and Australia accounted for 76% of lithium production in 2017; at 2017 consumption levels, current world lithium reserves can last more than 350 years. Today, about 46% of lithium production is used for batteries, and that figure is expected to increase up to 80% within a decade to satisfy the huge demand of lithium needed in the batteries for the electromobility revolution. Between 2016 and 2017 lithium production increased by 13%, and by 2025 lithium consumption can easily double the 2017 consumption number.

Lithium as A Strategic Resource

Chile is a leading country in South America, offering the best ranked business environment in the region by the World Bank 2019 Doing Business report. It is number 56 among 190 economies. It also offers one of the best environments for investments in the mining sector, number 8 according to the investment attractiveness index for the mining sector elaborated by the Fraser Institute.

In addition to its favorable business environment, Chile is favored with large reserves of lithium, which are found in brines below flat salt surfaces in the northern desert of the country. All that is needed for its extraction is the vast solid salt flat surface of the desert and the sun to evaporate the brine. In contrast, Australia's lithium reserves are found in hard-rock sources, which make them more expensive to process than brines.

By the end of 2017, the global supply of lithium was dominated by six producers: Albemarle, SQM, Tianqi, FMC, Orocobre, and Galaxy Resources.

The Chilean SQM and the American Albemarle are the only companies in Chile that have had contracts in force since the 1980s to extract lithium. These permits were granted by the Corporation for the Promotion of Production (Corfo), which, determines which projects can operate on behalf of the state.

The Chinese company Tianqi Lithium Corporation has a 51% participation in the Australian company Talison Lithium. The other 49% is controlled by Albemarle, and recently Tianqi bought 26.1% of the shares of SQM. For Tianqi, these ownership plus other stakes it has in lithium reserves in other places, lead it to a path of getting control over 70% of the global lithium market. That would give it control over a component that today is a strategic ingredient for batteries and the development of a world-class electric car industry.

Also, Tianqi with Albermarle, through the Talison joint venture, already controls half of the property of other lithium deposits in Chile, Siete Salares, which includes mining exploration concessions not yet exploited in an area of 152 km2. That endeavor could become the second largest lithium reserve in Chile, after the Salar de Atacama, where SQM and Albemarle have their operations.

The antitrust authorities in Chile expressed no main concerns and approved the entry of Tianqi Lithium Corporation in the property of SQM. However, the national economic prosecutor - who also supported the entry of Tianqi in the ownership of SQM - has acknowledged to the Chilean Congress that there is indeed an agreement between Albemarle and Tianqi to split the world market for lithium concentrate.

One of the main issues for Chile regarding this corporate operation is determination of the transfer prices. Tianqi has a strategy to extend its business by encapsulating both upstream and downstream activities in the lithium industries, and the coordination among global players could depress selling prices.

If the country can start trading lithium at lower than market costs, negatively affecting the taxes and the royalties that the Chilean government could collect from the sales, that would also negatively affect SQM minority shareholders locally and abroad.

One of the drawbacks for the global economy is the risk of market power that in lithium products, with the concentration of its production in a few large companies with a stake of more than 70% of the market.

China’s interest in leverage in the Chilean lithium industry is logical given the easy access to the resource and its low cost of production, compared with lithium production costs in other regions. That access will give Chinese industry an important competitive advantage in batteries and the electric car industry.

A Chilean high-level government official has confirmed that the authority is working on a plan to allocate new lithium production contracts to investors interested in giving an additional impulse to the development of the industry. It is looking for new partnerships that provide more than just an extractive activity and give much more value added to the Chilean lithium industry. But any new extraction activity on this venue, might take many years to materialize.

As explained in a recent US Geological Survey report, “Lithium supply security has become a top priority for technology companies in the United States and Asia. Strategic alliances and joint ventures among technology companies and exploration companies continued to be established to ensure a reliable, diversified supply of lithium for battery suppliers and vehicle manufacturers.”

In this new industry, Asian players are moving fast and decisively to take the control of the resources, demonstrating that the access to resources and the leadership of advanced energy technologies should be a priority for energy security and dominance in the 21st century.